avid and Kelly Arellanes hesitated when the AFL-CIO asked them to visit Washington as part of a union-led effort to encourage lawmakers to include a public insurance option in health care reform legislation. The Bryant, Ark. couple, broke due to medical bills, didn't want to look like they wanted help, or even sympathy.

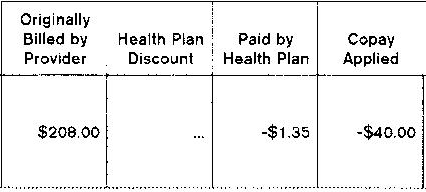

But they decided to make the trip after opening a bill for lab work related to the accident that bankrupted them. Out of a $208 balance, their health insurer, United Healthcare, had agreed to pay $1.35.

"When Kelly and I read it, it's like, 'Oh yeah, we're going tomorrow,'" said David, 55, in an interview with the Huffington Post. "If people did know the insurance companies are doing these things, then we might be able to do something good."

The Arellaneses, both retired AT&T workers and members of the Communications Workers of America union, considered the pitiful payment only the latest indignity in a long battle with United Healthcare. It started with a horseback riding accident on June 13, 2004, when Kelly Arellanes, now 50, fell out of her saddle and hit her head on a rock, severely injuring her brain. She was airlifted from the campground where the accident happened to a hospital in Fort Smith, Ark.

David recalls the doctor telling him they could do surgery to remove part of Kelly's skull, a risky operation she might not survive. Otherwise, she would die within an hour. "Honestly, I said a quick prayer, and in my head I heard these words: do it."

The doctor turned around without saying a word. David said he recalled taking his health insurance card out of his wallet and calling the 800 number on his cell phone to report what had happened to his insurer. But weeks later, after Kelly had come out of her coma unable to walk, talk, or even remember her family, David got a bill from the hospital for tens of thousands of dollars.

"The hospital said they hadn't received any payment from United Healthcare yet," said David. "That's when the argument started."

There were also two nearly-identical letters from the insurer. One said the company received word of Kelly's inpatient admission on the 15th of June; the other said notification arrived on the 30th. David said he couldn't make sense of the letters until he got on the phone with United.

"A representative over the phone said I didn't report it within the guidelines. I said no, I reported it on the 13th," David said. A few days later, it occurred to him that he had a record of his call. He got back on the phone with United Healthcare. "I'm sitting here looking at my cell phone and I'm looking at the time I called you. If you'd like, I could mail you a copy of this phone bill. He said, 'I don't know if that'd be necessary.'"

David said United Healthcare then claimed that the hospital his wife had been taken to was "out of network." He said the insurer agreed to pay for some parts of his wife's treatment, but the bills piled up.

"There was no consistency in what they would pay and what they refused to pay."

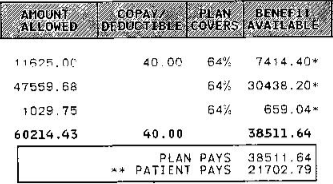

For instance, United covered $38,511.64 for Kelly's second hospital room after she left intensive care, leaving the Arellaneses on the hook for $21,702.79.

The couple refused to sign a disclosure form that would allow United Healthcare to confirm or deny allegations or comment on their case, because, David said, he doesn't trust the insurer not to lie.

"United Healthcare puts a high premium on providing accurate and friendly customer service and is committed to ensuring all its members are receiving the appropriate assistance to get the care they need," said spokesman Daryl Richard in a statement to the Huffington Post. "It is unfortunate and concerning that the Arellanes family will not give United Healthcare permission to address and further review any issues they may have experienced while receiving treatment for this accident."

That treatment, on top of the surgeries to remove and later replace part of Kelly's skull, involved anesthesiologists, radiologists, physical therapists, a pulmonary physician for a lung infection and an otolaryngologist for a damaged ear. They said they managed to pay about half of the $200,000 they owed. (David estimates the total cost was probably between $400,000 and $500,000.)

"We had stock with AT&T, we had investments, savings accounts, the money we had saved for our daughter's college, we had a motor home," he says. They sold the motor home, the investments, and used up their savings and their daughter's college fund, adds David. They filed for bankruptcy protection in late 2005 in order to keep their house. He says they'll be making monthly payments of about $1,600 from a fixed income of about $3,200 for another year and a half.

Most bankruptcies are caused by medical bills.

The couple brought a box full of bills to Washington last week to show their senators and congressmen what they'd been through. They met individually with Arkansas Sens. Blanche Lincoln (D) and Mark Pryor (D), along with Reps. Mike Ross (D), Marion Berry (D), and Vic Snyder (D), who represents their district. They said they pressed them all to support a public option.

"She was totally paralyzed: total amnesia, she couldn't read, write, speak, or add and subtract," David recalled telling them. "She couldn't do anything that every one of us takes for granted doing every day. But now look at her. The doctors cannot explain how she's recovered. In spite of United Healthcare, look at how she's recovered."

They showed their senators a picture of Kelly's head after the portion of her skull had been replaced.

"Unfortunately, as Kelly told me herself, their story is often the rule, and not the exception," said Sen. Lincoln in a statement. "That's why it is important we enact common-sense reforms to change the way insurance companies do business that will make a real difference in the lives of Arkansans and all Americans."

Kelly said she didn't understand what had happened to her until recently. "Four years after the incident things started making sense to me," she said. "It really started making sense about how we were basically being raped by our health insurance. I understood better why we filed bankruptcy."

She said she felt sure-footed when she shared her story with her elected representatives.

"I felt we were stating facts, and like I told all of them, I am not a primary story, I am an example of what is happening to people all across our country every day."

Read more at: http://www.huffingtonpost.com/2009/10/15/arkansas-couple-bankrupt_n_318068.html